The Carrying Amount of an Asset Is Equal to the

The fair market value of the asset at a balance sheet date. Consolidated 2010 2009 000 000 Financing arrangements Unrestricted access was available at balance date to the following lines of credit.

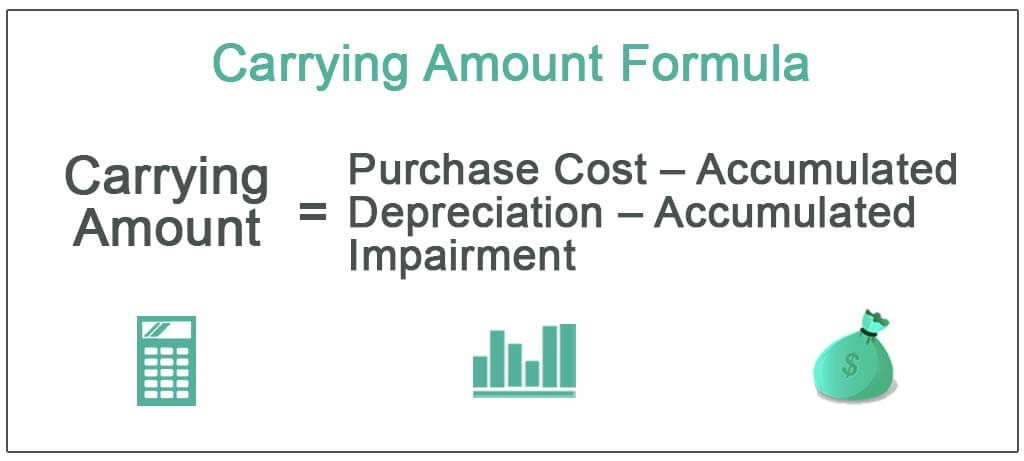

Carrying Amount Definition Formula How To Calculate

The carrying amount of an intangible is a.

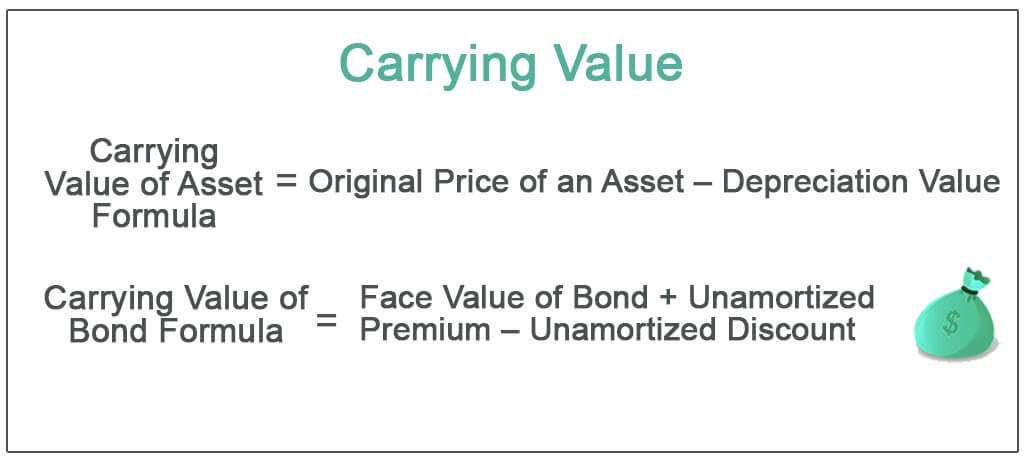

. Equal to the balance of the related accumulated amortization account. The assessed value of the asset for intangible tax purposes. Carrying amount also known as carrying value is the cost of an asset less accumulated depreciation.

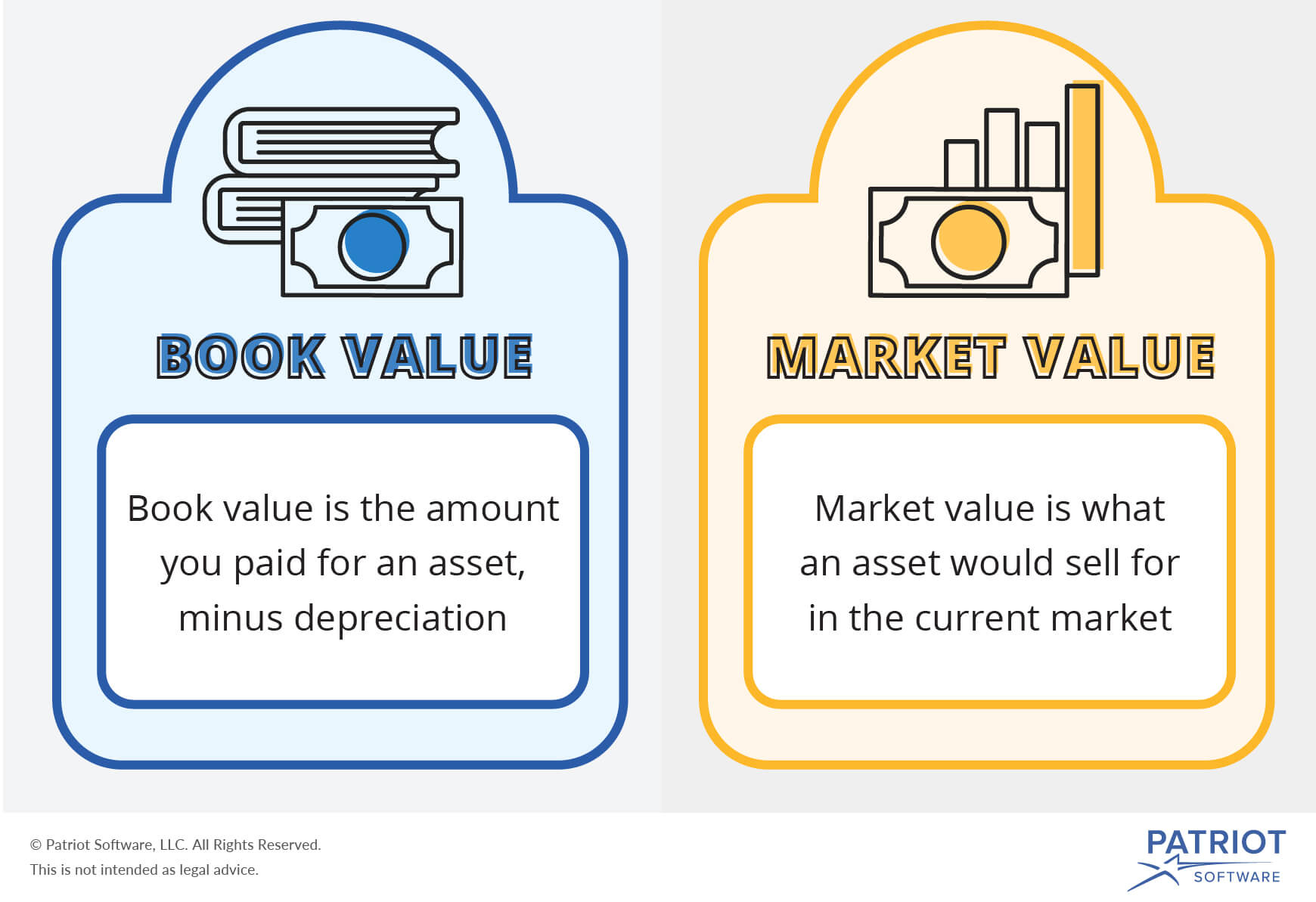

The carrying value of an asset is the figure you record in your ledger and on your companys balance sheet. An assets book value is equal to its carrying value on the balance sheet and companies calculate it by netting the asset against its accumulated depreciation. If the carrying amount of an asset equals its selling price at the date of sale then a a gain on disposal is recorded.

Total facilities - Bank debt funding facility 190000 184347 - Multi-option facility including. The assets acquisition cost less the total related amortization recorded to date. The fair value of land is reliably determined to be 2800000.

C assets cost less residual. Carrying amount is the value of an asset as it appears on the balance sheet and is acquired after deducting its accumulated depreciation and impairment expenses. As a result of the exchange the entity shall recognized a.

If the carrying amount of an asset equals its selling. Eliminate the accumulated depreciation against the gross carrying amount of the newly-revalued asset. An assets book value is equal to its carrying value on the balance sheet and companies calculate it by netting the asset against its accumulated depreciation.

A loss equal to the cash given up b. Carrying amount and market value differ in many ways as listed below. B assets cost less residual value less accumulated depreciation.

The carrying amount is the original cost adjusted for factors such as depreciation or damage. Accounting questions and answers. The carrying amount or carrying value of the receivables is 81000.

The carrying amount of assets pledged as security are equal to those shown in the consolidated statement of financial position. B no gain or loss on disposal is recorded. The carrying amount of an asset is equal to the a assets fair value less its original cost.

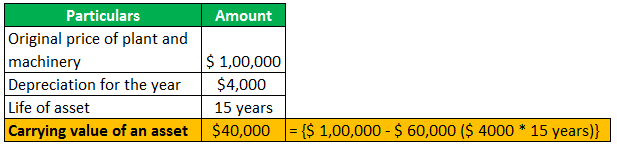

The trucks carry amount or book value is 7000. The residual value may increase to amount equal to or greater than the carrying amount. A company has a truck that has its cost of 50000 in its account entitled Truck.

The entity also contributed cash. This method is the simpler of the two alternatives. A corporation has Bonds Payable of 3000000 and Unamortized Discount on Bonds Payable of.

Force the carrying amount of the asset to equal its newly-revalued amount by proportionally restating the amount of the accumulated depreciation. A loss determined by the proportion of cash paid to the total transaction value c. These factors may not reflect what the asset would sell for.

The market value of an asset on the other hand depends on supply and demand. At reporting date the carrying amount of a cash generating unit was considered to be have been impaired by 1000000. Residual Value except When a third party is committed to buy the asset at the end of the useful life.

The carrying amount is equal to the cost of the asset less the accumulated depreciation. C the asset is fully depreciated. The unit included the following assets.

Your account books dont always reflect the real-world value of your business assets. The associated account Accumulated Depreciation has a credit balance of 43000. In an exchange of assets an entity received equipment with a fair value equal to the carrying amount of equipment given up.

The carrying amount of building after impairment loss is. When a financial asset at FVPL is reclassified as FVOCI the new carrying amount is equal to Date of record It is the date on which the stock and transfer book of. The carrying amount is usually not included on the balance sheet as it must be calculated.

Carrying Value Definition Formula How To Calculate Carrying Value

/GettyImages-1091470486-5b4ac16f07264b1a8b3738289324bfe5.jpg)

Carrying Value Vs Fair Value What S The Difference

Strategic Communication Plan Template Beautiful Top 5 Resources To Get Free Stra Strategic Planning Template Business Plan Template Communication Plan Template

Advantages Disadvantages Of Hypothecation Accounting And Finance Financial Strategies Financial Analysis

Saudi Company Signs Mou To Invest In 12 Billion Real Estate Project In Pakistan Investing Street View Offshore

3 Stocks That Have Soared As The Market Sank Are They Buys Now The Motley Fool In 2022 The Fool The Motley Fool Motley

Image Result For Factoring For Finance Finance Accounting And Finance Business Finance

Ltm Revenue Money Management Advice Financial Strategies Financial Analysis

Capital Lease Obligation In 2021 Financial Management Learn Accounting Bookkeeping And Accounting

What S The Difference Between Book Value Vs Market Value

Carrying Value Definition Formula How To Calculate Carrying Value

Capital Lease Obligation In 2021 Financial Management Learn Accounting Bookkeeping And Accounting

Instead Of Having A Bunch Of Stuff But Struggling In Debt Or Broke Most Of The Time Invest In Yo Investing Pinterest Business Strategy Small Business Growth

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting

General Ledger With Budget Comparison General Ledger Budgeting Financial Management

/pen-and-coins-on-financial-statement-1041019842-3fb97638d9f24424b156c88410a51848.jpg)

Comments

Post a Comment